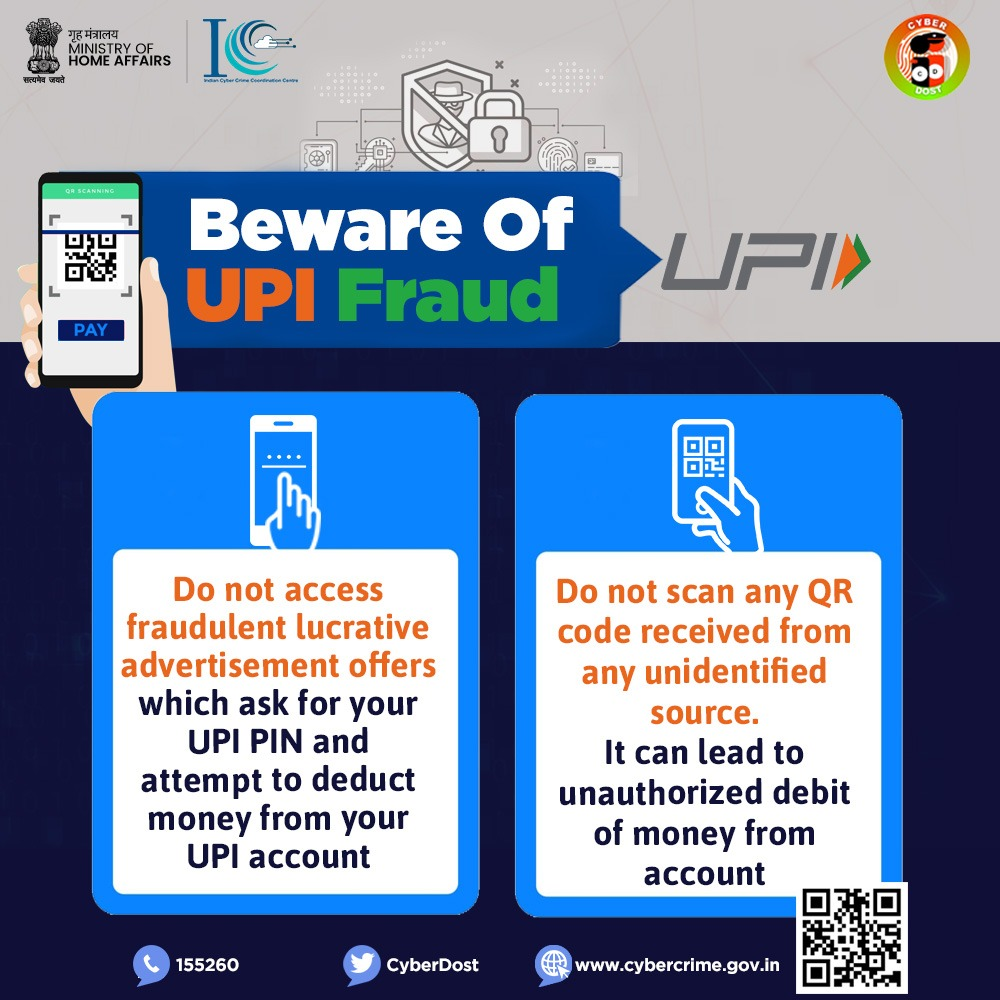

THESE TIPS TO DO SAFE TRANSACTIONS AND NOT BE VICTIM OF UPI FRAUD

Due to the ever-increasing convenience and simplicity of digital payments, UPI (Unified Payments Interface) has emerged as one of India-wide carts-payment methods. The system revolutionized the way we approach with our financial transaction but at the same time, it turned to be a pretty vulnerable target for cybercriminals trying their best exploiting unaware users. According to the important alerts issued by Cyber Dost —a citizen helpline initiative of Ministry of Home Affairs, in this blog post we will see how UPI frauds occur and what one can do better ensure their own protection.

Key Frauds and How to Avoid Them

1. Fraudulent Lucrative Advertisement Offers :

Fraudsters have gone as far to circulate fake advertisements that appear to provide discounts, rewards or prizes on the internet. Such ads generally ask for your UPI PIN to take care of the offer. Unfortunately, they when you enter UPI PIN in frudulant platforms then the amount is directly unauthorised debit from your linked back account.

How to Protect Yourself:

- Do not share your UPI PIN: Your PIN is a secret code that you should enter only when making transactions on known and authenticated applications.

- Always be careful: If you receive an offer that is too good to be true, check before interacting with it.

- Always Use Official apps: Always use official mobile application provided by the respective bank/payment processors to do any online transactions.

2. QR Code Scams :

Yet another kind of scam that has started making its way is the one in which eating houses get QR codes from unknown or unauthorized sources. Here, scamsters send you a QR code that they claim can help transfer money into your account. But in practice, scanning these fake QR codes would usually lead to illegal money deduction from your account.

How to Protect Yourself:

- Scanning unknown QR code: Before you scan any But just locally drawn one to verify the authenticity of the source, especially if it is unsolicited.

- Learn how QR code will work : You can perform both Money transfer and payment using scanning of a QR Code as auth! Just be mindful of what you are authorizing when scanning one.

- Stay Updated — Always ensure your UPI apps up to date as an added security feature provided by the banks.

How Cybercriminals Trick You

Cybercriminals employ social engineering methods to manoeuvre users into providing confidential information regarding their finances. Whether it's through phony ads, or scams on QR codes their objectives are always to get a hold of your funds, without permission.

The Delinquency Maker Often times, the fraudster will create a scenario that forces emotional pressure on our victim to manipulate him or her into making mistakes without taking time with due diligence. For example, they may tell you that if you do not take action right now the offer will be gone or promise this is how to redeem your prize in a faster manner by scanning on QR code.

How Can You Stay Safe?

The following are important precautions to keep in mind when attempting to deal with UPI fraud:

- Trust and verify: Get official confirmation of any unusual financial request or offer before doing anything.

- Never share sensitive information: Do not disclose your UPI PIN, OTPs (One-Time Passwords), or bank details with anyone even if the offer or message is convincing enough.

- Set up for 2-step verification: Use a two-factor authentication facility so that the UPI apps and accounts linked to you are more secure.

These activities point your town and can be raised to the authority on their helpline numbers initiated by Government of India like Cyber Dost.

Beware of UPI Fraud: Essential Tips for Safe Transactions